一、本课程共有51个教学微视频,共12章节,课程习题435道,视频总时长达约500分钟。

二、本课程共32个学时,2学分,开课时间为2024年1月31日 至2024年7月31日;

三、 本课程内容共分为12个模块,第一模块内容为 International Tax and Bases for International Tax: Jurisdiction Taxations;第二模块内容为 International Income Taxation;第三模块内容为Tax Residence;第四模块内容为Income Source Jurisdiction and Rules;第五模块内容为 International Double Taxation and Relief;第六模块内容为International Tax Avoidance and Tax haven;第七模块内容为 International Transfer Pricing and Rules;第八模块内容为Controlled Foreign Corporation and Rules;第九模块内容为Thin Capitalization and Rules;第十模块内容为International Tax Treaty;第十一模块内容为International Tax Competition and Harmonization;第十二模块内容为International Income Taxation in Digitalized Economy。本课程配套线下教材为课程负责人葛夕良主编的《Internation Taxation》(浙江工商大学出版社);

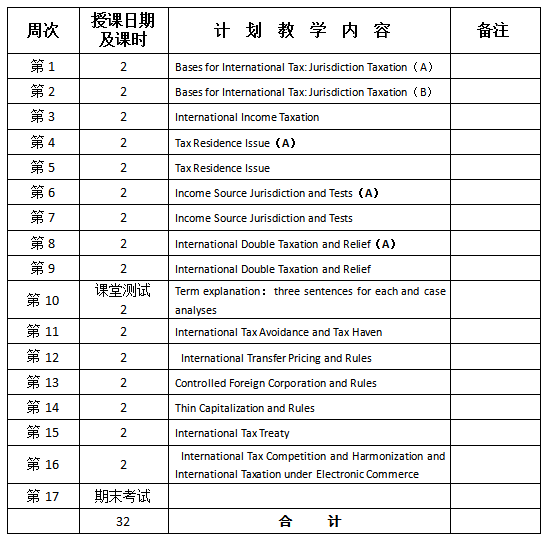

四、教学计划如下:

教学内容+课时

五、授课方式介绍: 线下和线上融合,也可线上完成全部教学环节。配套教材,教学大纲及参考资料详见相关文档。

六、成绩评价: 线上和线下融合、过程性评价与终结性评价相结合的多元化课程评价体系;

线上成绩是以“视频观看时长、完成测试、考试、作业情况及论坛发帖”之成绩为计算依据,各项目占比如下:

(1)视频观看占40%;

(2)作业成绩占15%;

(3)测验成绩占15%;

(4)考试成绩占20%;

(5)发帖讨论成绩占5%,普通帖子0.5分一个,精华帖子1分一个;

(6)笔记成绩占5%

(本课程最终成绩 = 线上成绩*权重值(0.4)+线下成绩*权重值(0.6)。

A-B: A. What is “International Tax”? and B.What is “Jurisdiction Taxation”?

A-B: A. What is “International Tax”? and B.What is “Jurisdiction Taxation”?

A-B: A. What is “International Tax”? and B.What is “Jurisdiction Taxation”?

C-D: C.Relationship between both D.Taxations in the USA and Ireland

C-D: C.Relationship between both D.Taxations in the USA and Ireland

C-D: C.Relationship between both D.Taxations in the USA and Ireland

Answers to some textbook questions in Chapter 1

Answers to some textbook questions in Chapter 1

Answers to some textbook questions in Chapter 1

Chapter 2 International Income Taxation

A-B: A. Understandings of “International Income Taxation B.Income tax systems in the world

A-B: A. Understandings of “International Income Taxation B.Income tax systems in the world

A-B: A. Understandings of “International Income Taxation B.Income tax systems in the world

C-D: C. How to design its income taxation system? D.Main Contents of International Income Taxation

C-D: C. How to design its income taxation system? D.Main Contents of International Income Taxation

C-D: C. How to design its income taxation system? D.Main Contents of International Income Taxation

Answers to some textbook questions in Chapter 2

Answers to some textbook questions in Chapter 2

Answers to some textbook questions in Chapter 2

Chapter 3 Tax Residence

A-B: A. General Theories of “Tax Residence” B.Tests for Tax Residence of Individuals.

A-B: A. General Theories of “Tax Residence” B.Tests for Tax Residence of Individuals.

A-B: A. General Theories of “Tax Residence” B.Tests for Tax Residence of Individuals.

C.Tests for Residence of Legal Entities.

C.Tests for Residence of Legal Entities

C.Tests for Residence of Legal Entities.

D.Tax Residence Rules in China

D.Tax Residence Rules in China

D.Tax Residence Rules in China

Answers to some textbook questions in Chapter 3

Answers to some textbook questions in Chapter 3

Answers to some textbook questions in Chapter 3

Chapter 4 Income Source Jurisdiction and Rules

A.General Theories

A.General Theories

A.General Theories

B.What is “Permanent Establishment”?

B.What is “Permanent Establishment”?

B.What is “Permanent Establishment”?

C-D: C.Income Source Rules in U.S.A D.Income Source Rules in China

C-D: C.Income Source Rules in U.S.A D.Income Source Rules in China

C-D: C.Income Source Rules in U.S.A D.Income Source Rules in China

Answers to some textbook questions in Chapter 4

Answers to some textbook questions in Chapter 4

Answers to some textbook questions in Chapter 4

Chapter 5 International Double Taxation and Relief

A. General theory

A. General theory

A. General theory

B. How to relieve international double taxation?

B. How to relieve international double taxation?

B. How to relieve international double taxation?

C. Methods to relieve international double taxation in China

C. Methods to relieve international double taxation in China

C. Methods to relieve international double taxation in China

D. Calculation

D. Calculation

D. Calculation

Answers to some textbook questions in Chapter 5

Answers to some textbook questions in Chapter 5

Answers to some textbook questions in Chapter 5

Chapter 6 International Tax Avoidance and Tax haven

A. Definition of related concepts

A. Definition of related concepts

A. Definition of related concepts

B. Categories of tax havens

B. Categories of tax havens

B. Categories of tax havens

C. How to use tax havens to avoid tax

C. How to use tax havens to avoid tax

C. How to use tax havens to avoid tax

D. Anti-tax haven measures

D. Anti-tax haven measures

D. Anti-tax haven measures

Answers to some textbook questions in Chapter 6

Answers to some textbook questions in Chapter 6

Answers to some textbook questions in Chapter 6

Chapter 7 International Transfer Pricing and Rules

A. Concepts Definition

A. Concepts Definition

A. Concepts Definition

B1. Arm’s Length Principle

B1. Arm’s Length Principle

B1. Arm’s Length Principle

B2. Arm’s Length Principle

B2. Arm’s Length Principle

B2. Arm’s Length Principle

C. Gross Profit Principle

C. Gross Profit Principle

C. Gross Profit Principle

D. China International Transfer Pricing Rules

D. China International Transfer Pricing Rules

D. China International Transfer Pricing Rules

Answers to some textbook questions in Chapter 7

Answers to some textbook questions in Chapter 7

Answers to some textbook questions in Chapter 7

Chapter 8 Controlled Foreign Corporation and Rules

A. Controlled Foreign Corporation and General Rules

A. Controlled Foreign Corporation and General Rules

A. Controlled Foreign Corporation and General Rules

B. Rules in Different Countries

B. Rules in Different Countries

B. Rules in Different Countries

Answers to some textbook questions in Chapter 8

Answers to some textbook questions in Chapter 8

Answers to some textbook questions in Chapter 8

Chapter 9 Thin Capitalization and Rules

A. Thin Capitalization

A. Thin Capitalization

A. Thin Capitalization

B. Thin Capitalization Rules

B. Thin Capitalization Rules

B. Thin Capitalization Rules

C. Thin Capitalization Rules in China

C. Thin Capitalization Rules in China

C. Thin Capitalization Rules in China

Answers to some textbook questions in Chapter 9

Answers to some textbook questions in Chapter 9

Answers to some textbook questions in Chapter 9

Chapter 10 International Tax Treaty

A. General Theories of International Tax treaty

A. General Theories of International Tax treaty

A. General Theories of International Tax treaty

B. Main contents of International Tax Treaty

B. Main contents of International Tax Treaty

B. Main contents of International Tax Treaty

C. International Treaty Shopping and Anti-Rules

C. International Treaty Shopping and Anti-Rules

C. International Treaty Shopping and Anti-Rules

D. International Tax Treaties in China

D. International Tax Treaties in China

D. International Tax Treaties in China

Answers to some textbook questions in Chapter 10

Answers to some textbook questions in Chapter 10

Answers to some textbook questions in Chapter 10

Chapter 11 International Tax Competition and Harmonization

A. Concept of International Tax Competition

A. Concept of International Tax Competition

A. Concept of International Tax Competition

B. Reactions to International Tax Competition

B. Reactions to International Tax Competition

B. Reactions to International Tax Competition

C. Advantages and Disadvantages of International Tax Competition

C. Advantages and Disadvantages of International Tax Competition

C. Advantages and Disadvantages of International Tax Competition

D. International Tax Harmonization

D. International Tax Harmonization

D. International Tax Harmonization

Answers to some textbook questions in Chapter 11

Answers to some textbook questions in Chapter 11

Answers to some textbook questions in Chapter 11

Chapter 12 International Income Taxation in Digitalized Economy

A. Digitalized Economy and E-commerce

A. Digitalized Economy and E-commerce

A. Digitalized Economy and E-commerce

B. Overview of Income Tax Issues

B. Overview of Income Tax Issues

B. Overview of Income Tax Issues

C-D: C. Direct Tax Issues Addressed by the OECD D.China's Countermeasures

C-D: C. Direct Tax Issues Addressed by the OECD D.China's Countermeasures

C-D: C. Direct Tax Issues Addressed by the OECD D.China's Countermeasures

Answers to some textbook questions in Chapter 12

Answers to some textbook questions in Chapter 12

Answers to some textbook questions in Chapter 12